- Multifamily Man's Newsletter

- Posts

- IRRs Are Not Real

IRRs Are Not Real

Truth = Yield on Cost

No one has a crystal ball… especially regarding what a property will sell for (which are highly dependent on exit cap rates). Asset sales prices are more (or should be) like a range of outcomes than backing into a price. You can’t predict the future. Great real estate operators know this and understand how to position a deal to their investors accordingly. You can present your underwrites on a deal as conservative, relative to other operators, by focusing on cash generated by the asset. This is in your control. You can gauge with some certainty how much Yield a deal can generate. More importantly a stabilized yield. An asset’s stabilized yield on cost is the truth. The more yield created, the closer to a positively skewed outcome the deal becomes.

Stabilized Yield on Cost =

Stabilized Market NOI (Market Rents - Market Expenses) / Total Invested $$$ (Purchase Price + Closing Costs + Capital Invested)

The stabilized yield on cost represents the value an operator creates with respect to the basis of a deal. A low SYOC means you bought too expensive or didn’t create value. Having greater yield gives investors more cash, creates more flexibility in refinance scenarios and drives value.

An operator needs capital to buy deals. In essence, you’re solving for what equity is attracted to. Right now, investors are attracted to bargain prices with distributable cash. If investors can buy treasuries at 5%, why would they take the risk of investing in a real estate deal at or close to the same return? Most wouldn’t - which is why market acquisitions are dominated by private capital and family offices who don’t care about yield, and the remaining retail syndicators who are promising sky-high IRRs.

Many groups are struggling to raise money because of this issue. There is no yield in multifamily real estate. Most operators are leaning into appreciation. This is a huge reason why affordability with real estate tax abatements has become so prominent. The abatement creates yield. And not coincidentally, investors want yield.

The long-term average spread of Multifamily cap rates to the 10-year Treasury is about ~250 basis points. Treasuries are a bit volatile as I write this, but I can tell you that ~7% stabilized YOCs for a B asset in a good location will get equity on board. At 6.5% you will struggle to raise, and anything beneath that the deal has to be incredibly unique to get funded. If rates start to come down even more, perhaps in mid-3%, then perhaps stabilized yield exepectation will become a bit more lenient. Until then, I would focus on reasonably achieving +7% stabilized YOCs.

The struggle is multifamily market cap rates are around 5% across the country. Rent growth is flat, operating costs are growing, and the economy is softening. So how do you take a 5% cap rate (which is closer to 4-4.5% YOC after costs) and create enough value to hit a 7% YOC in 3 years? You don’t. It’s not real.

To solve this issue, an operator has to buy at the right price and know where rents can be driven with a high degree of confidence.

An operator with a deep understanding of assets at the neighborhood level—down to the specific block—excels here. This isn’t about macro bets; it’s about micro insights.

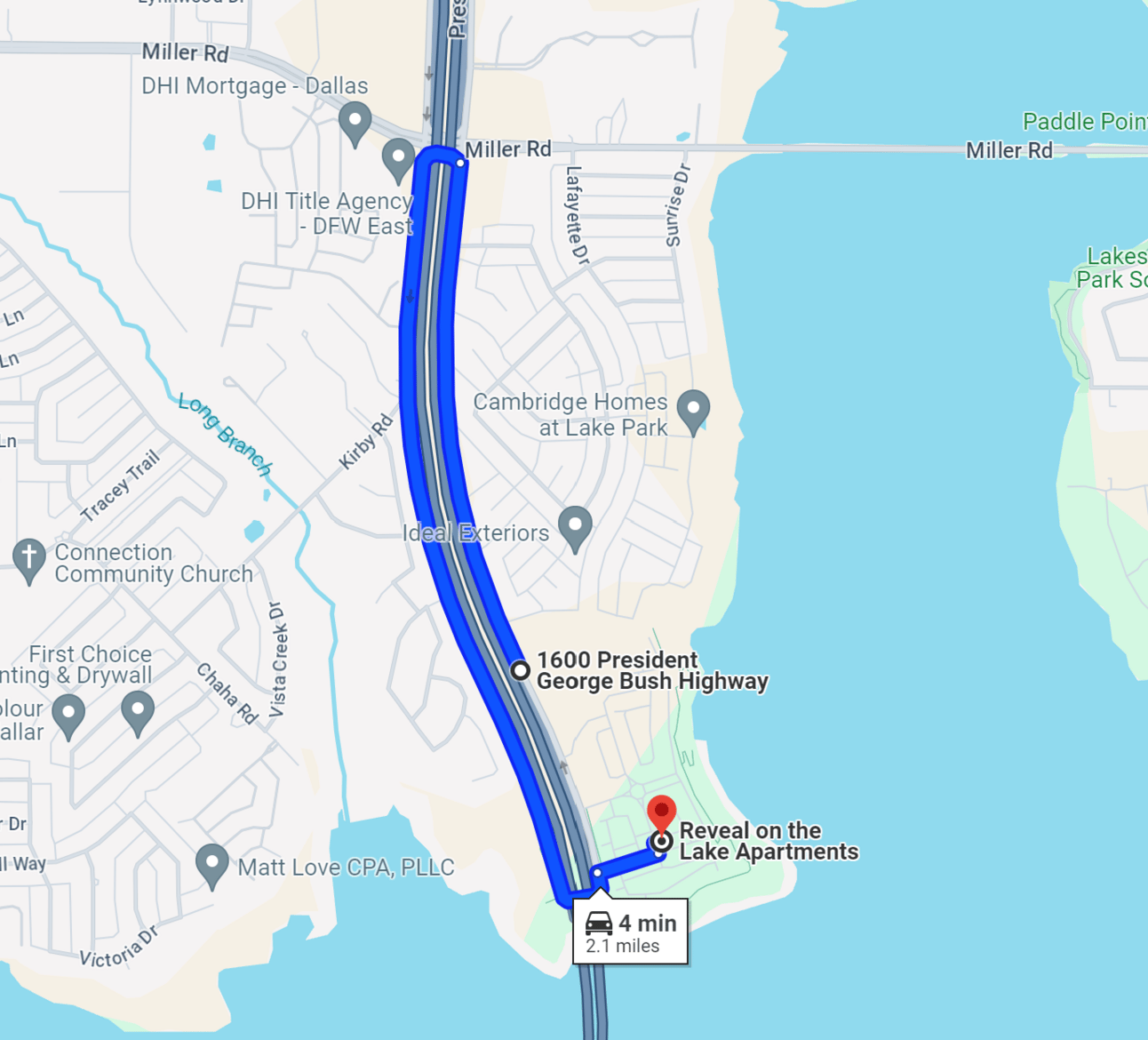

For example - if you miss this property’s entrance, one has to take a 2 mi U-turn…(I might just turn into the neighbors’ property and rent there). Having this level of insight is the difference between $5,000 dollars of marketing expenses or $25/unit/mo of rent, which is $100,000 of value!

What are the rents for 1bds, 2bds, 3bds?

How do the rent comparables stack up on amenity sets?

What are the interior finish-outs? How do they compare?

What are the average square footage sizes on each unit type?

Who are the local management teams? Who is good/bad?

Is the property visible from major roads? Is the access different?

Is this street better than the one a mile away? What about the corner?

Are the floor plans awkward?

How are the schools in this neighborhood vs the other?

What about nearby retail? Grocers? Outdoor amenities?

Is there nearby supply coming soon?

What are the local demographics? How does that affect desired units?

A solid operator should be able to qualify the differences. They should know which pocket is better than others. This is part of creating the narrative on why this specific subject asset should be investable. Then, they should be able to quantify the differences through rent comps. The rent comps should support the narrative, which all funnel into where the target acquisition should sit in a stack of properties.

When you see a deal with rents at $1,000/unit, and the surrounding comparables are at $1,250/unit, you need to know where your deal can go. Is it justified to hit $1250? Or maybe $1300 is right because the pocket is better than that other deals. That’s where understanding the block comes in. You need to be confident and supported by hard data. Not just a projection based on gut.

All of these data points support yield. And again, investors want yield.

There’s a “cheat” to achieve distributable yield (Cash on Cash): Assumptions.

(Cash on Cash [CoC] = Annual Levered Cash Flow (post AM fee) / Invested Equity)

With rates having hockey-sticked so quickly, there’s an entire market for assuming loans at yesterday’s low rates. Accretive loans. While the market price may support 5% yields upon acquisition today, deals with assumptions could support 4% or under.

Why?

Because if the loan rate is 3%, you can still hack your way to a 7% CoC, even if your yield is below 5%. But, there’s one big caveat: your basis. You are paying a premium price for an asset with a financial instrument (the assumption) priced in. It is important to understand the present value of the assumption. At some point, you will have to sell. If you paid too much for enhanced synthetic cash flows, you might be stuck! Again, you have to buy at the right price—one that supports a pop on the sale.

So, your purchase price and business plan have to be right.

This is where having a deep understanding of everything going on in a market comes into play. Anyone can slap a 4.5% exit cap on a deal for a 20% IRR. Not everyone can find the right purchase price, push the right yield, and secure a strong risk-adjusted return.

Again… projecting sales is more about probability than certainty

The job of a sponsor is to generate enough yield, have enough runway (through longer duration debt), and maintain strong business practices where an acquisition is downside protected (no loss of capital), highly probability of mid-teen IRRs (2x equity in 5 years), and positioned to take advantage of market volatility to produce home-run returns (selling at the peaks).

Forget about the IRR. Make sure the yield is right!